Make Better Financial Choices

Get your financial plan worth ₹ 2,499/- for Only 499/-

How can our advisor guide your financial journey?

Income & Expense Planning

Optimize your income and expenses to establish long-term financial stability

Investment Planning

Optimize your investment strategy for higher returns and lasting growth

Insurance Planning

Review your insurance policies and identify coverage gaps with the help of a qualified advisor

Loan Planning

Effective loan planning helps manage debt, optimize repayments, and align with your financial goals for better stability

Retirement Planning

Retirement planning ensures financial security by saving and investing wisely to meet future needs and lifestyle goals

Tax Planning

Our expert will minimize your tax liabilities through strategic tax planning.

Financial Calculators & Tools

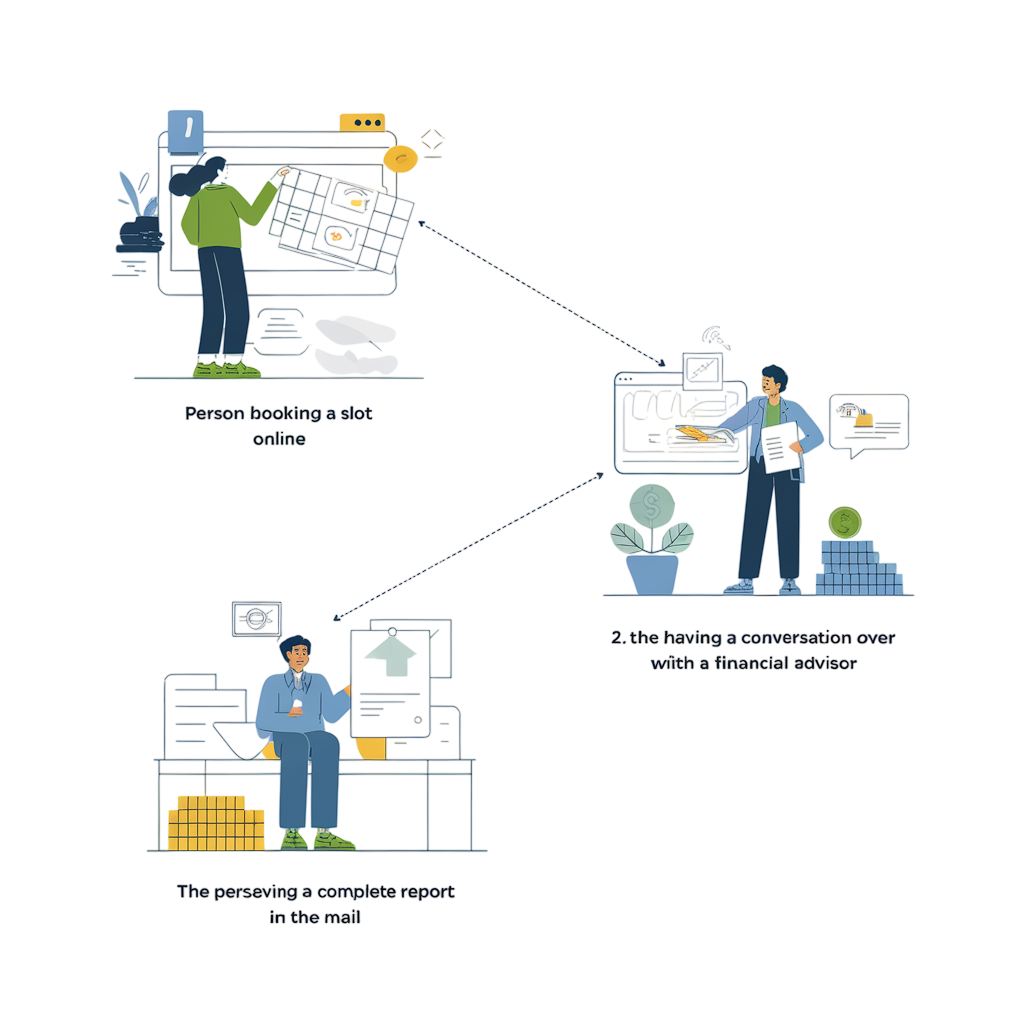

How it Works

What can you expect to receive from personal financial advisory?

Investment Guidance: Know exactly where to invest in Mutual Funds, ETFs, and Stocks based on your goals.

Tax Savings: Learn strategies to reduce tax liabilities and maximize savings.

Retirement Planning: Set clear goals for a comfortable, secure retirement.

Children’s Education: Plan for your children's future education expenses.

Medical Insurance: Secure health coverage to protect against medical emergencies.

Life Insurance: Ensure financial security for your family in case of unforeseen events.

Emergency Fund: Build a safety net for unexpected situations.

What makes us the right choice for your financial planning needs?

Expertise and Experience

We have a team of highly qualified financial planners with years of experience in guiding clients through complex financial decisions. Our deep understanding of financial markets, tax laws, and investment strategies ensures that you receive expert advice tailored to your unique situation.

Personalized Financial Plans

We don’t believe in a one-size-fits-all approach. Our financial planning services are fully customized to align with your specific goals, whether it's retirement planning, saving for education, or managing debt. We take the time to understand your financial aspirations and challenges before crafting a strategy that suits you.

Comprehensive Financial Services

From investment management to estate planning, tax optimization, and retirement strategies, we offer a wide range of services that cover every aspect of financial planning. This holistic approach ensures that all areas of your financial life are coordinated and working together to achieve your long-term objectives.

Transparency and Trust

We prioritize building a trusting relationship with our clients by maintaining full transparency in our recommendations and fees. There are no hidden charges, and we take time to explain all aspects of your financial plan. You can rest assured that your financial well-being is our top priority.

Proven Track Record of Success

Our track record speaks for itself. We’ve helped numerous clients achieve their financial goals through disciplined planning, strategic investments, and timely adjustments. We measure our success by your success and are committed to delivering results that matter to you.

Ongoing Support and Guidance

Financial planning is not a one-time event; it’s a continuous process. As your financial life evolves, we’ll be with you every step of the way, providing ongoing support, advice, and adjustments to ensure that your financial plan stays on track with your changing needs and life circumstances.